Hi folks,

Technology is moving at Godspeed. To better identify relative strength, I curated an ETF watchlist that offers exposure to companies poised to benefit from the AI-infused paradigm shift.

The list is sorted by proximity to its 52W high and features broad market, sector-based, thematic, and income-generating ETFs. I’ve tried to include a little something for everyone.

ETFs are great tools for investors. The funds mitigate single-stock risk and allow investors to participate in a broader theme without having to pick winners.

At times, we may feel underexposed to the next high flyer, but investing is about longevity.

ETF OF THE WEEK

Each week, I will highlight a single ETF. It could be the best performer. Or simply on the verge of its next leg higher. That’s for you to wait and see.

This week, Global X Autonomous & Electric Vehicles ETF, $DRIV, is the ETF of the Week.

$DRIV holds 74 future-focused stocks tracking Solactive’s Autonomous & Electric Vehicles Index.

It’s a market-cap-weighted fund that seeks to invest in companies developing autonomous vehicle technology, electric vehicles (“EVs”), and EV components and materials.

$DRIV’s top-10 holdings include,

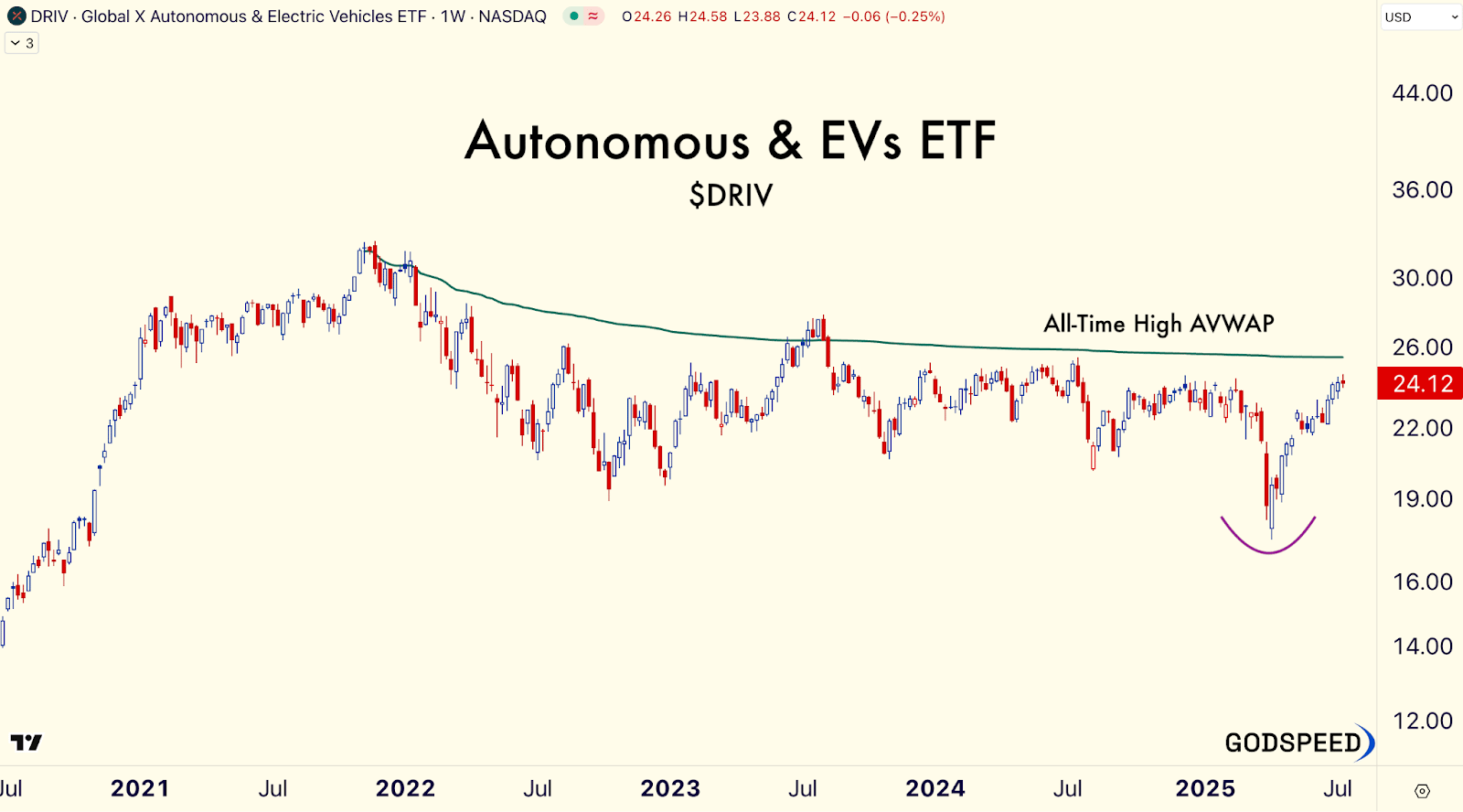

The Fund still trades within its 3-year base and rests ~25% below its 2021 all-time high. Here’s the weekly chart.

EVs have captured headlines on Wall Street for more than a decade. But — autonomous vehicles are in the midst of a hockey stick moment.

This week, Waymo surpassed 100M fully autonomous miles driven on public roads. That’s more than 200 trips to the Moon and back.

And last month, Tesla launched its robotaxi service in Austin. The company has since expanded its geofence and applied for permits to operate in the Phoenix metro area.

Autonomous driving is no longer a sci-fi fantasy. It’s here. It’s happening.

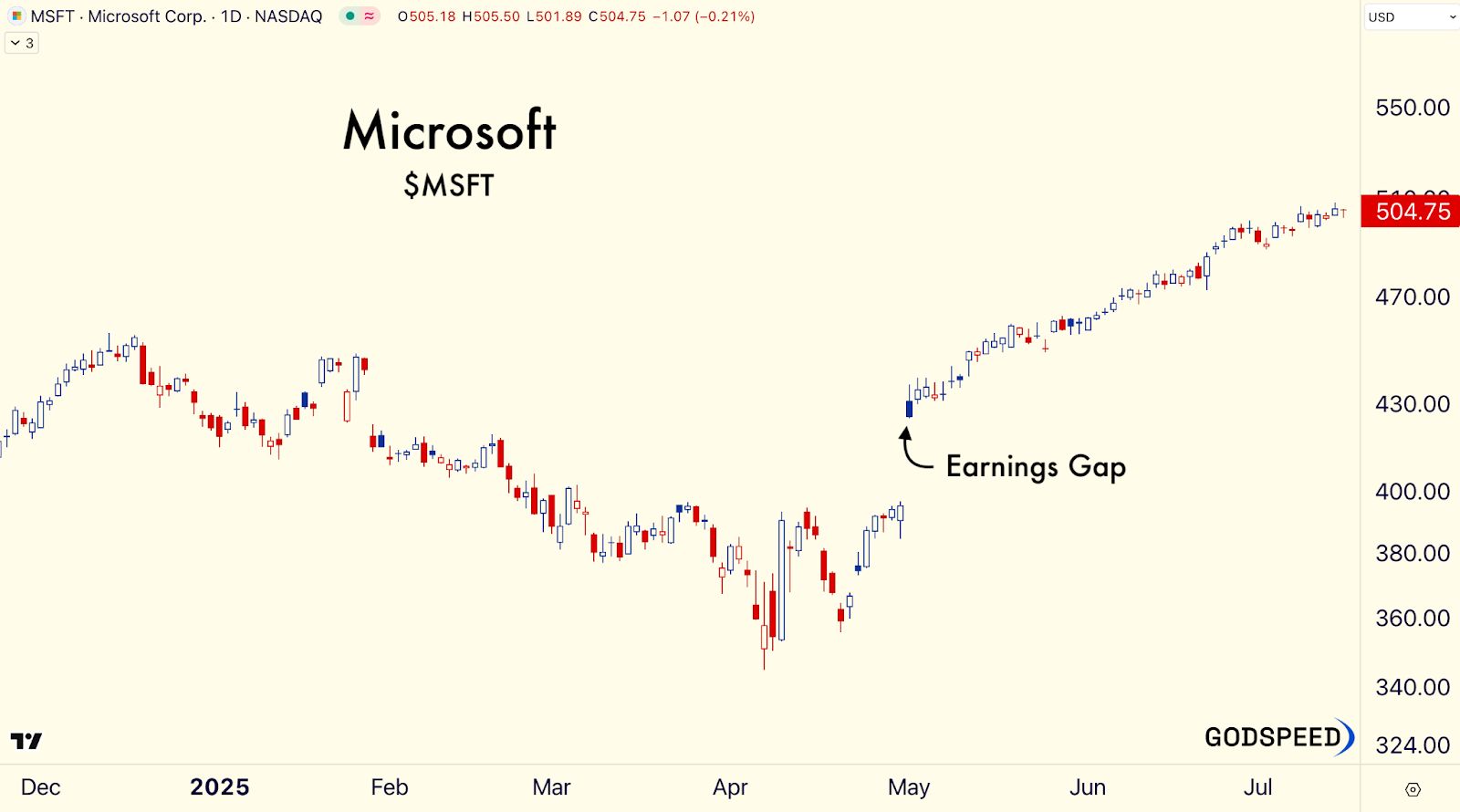

Microsoft ($MSFT) is $DRIV’s largest holding. Through its Azure cloud services, the company serves as the data superhighway and infrastructure layer for the entire autonomous vehicle stack — from data ingestion and model training, to simulation / testing, over-the-air updates and in-cabin digital services.

Nearly every major automaker, including Toyota, BMW, GM, Volkswagen and Mercedes-Benz, leans on Microsoft to accelerate autonomous vehicle R&D.

$MSFT has driven in a straight line higher. Since its April 30th earnings report, the stock is up 27%. Here’s the daily chart.

Nvidia ($NVDA) is the premier picks and shovels company enabling the AI-infused paradigm shift. Its Drive platform has become the industry standard for self-driving systems worldwide. Since 2024, Nvidia’s automotive segment has grown +80% YoY as it enables major automakers to adopt autonomous technology.

Without Nvidia, the “hockey stick” moment for autonomous vehicles wouldn’t be possible.

$NVDA is up 25% YTD and has already broken out of its 1-year base. Here’s the daily chart.

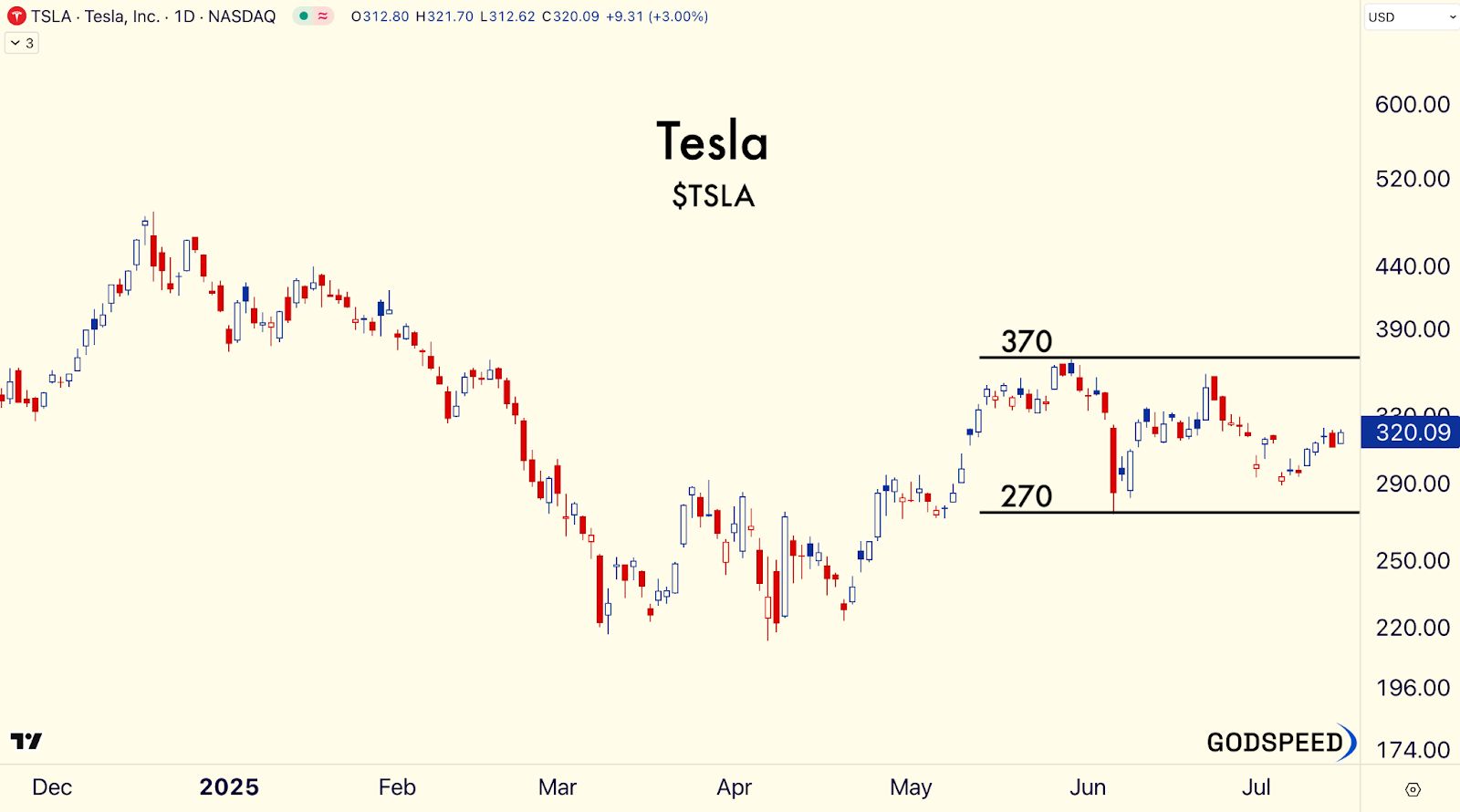

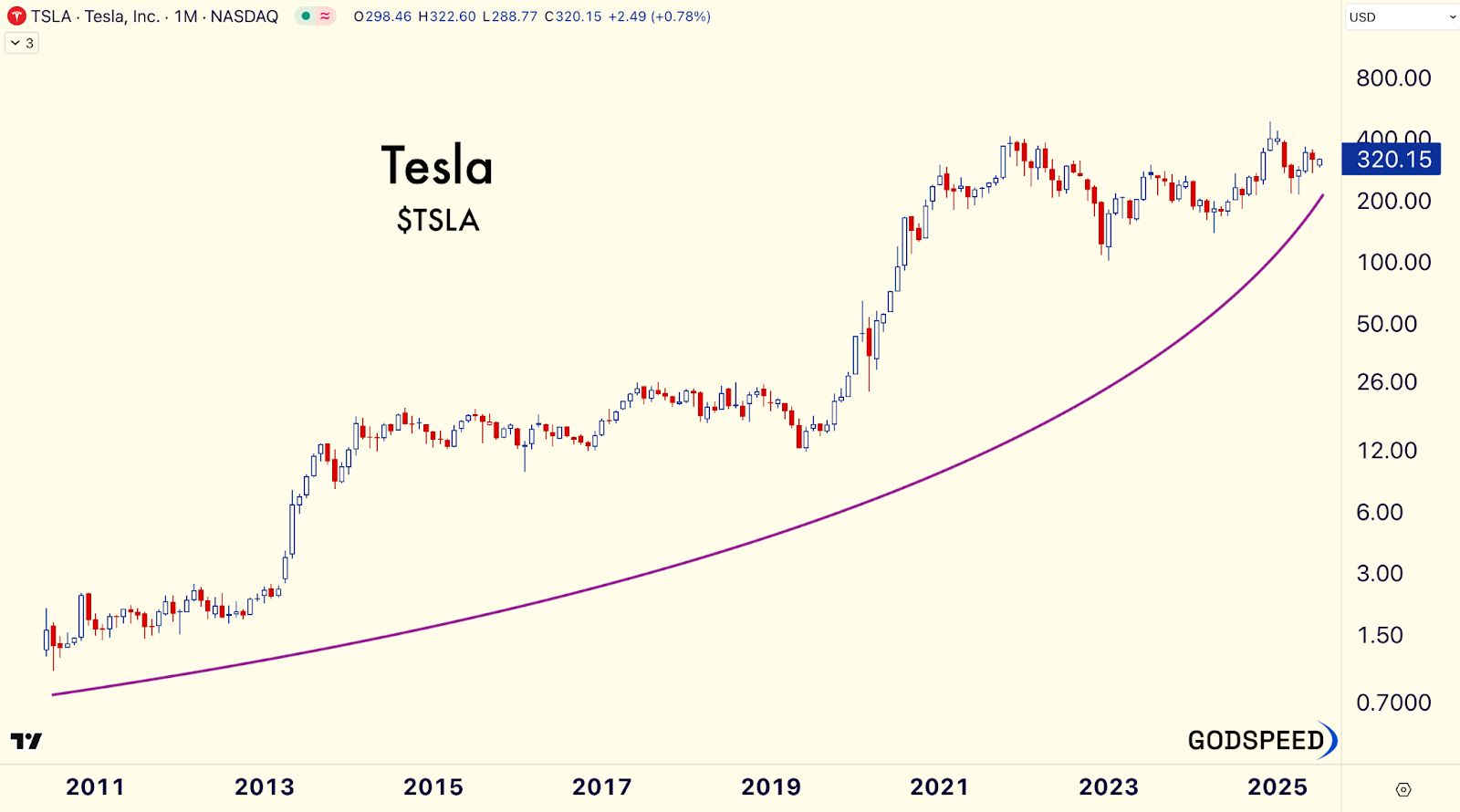

Tesla ($TSLA) sits at the tip of the autonomous spear. The company’s vertically integrated approach, from in-house AI processors to real-world fleet data and continuous software updates, gives it a first-mover advantage that no other automaker can match.

Since June, Tesla’s new geofenced robotaxi service has doubled its operating area in Austin and seeks to expand into the Phoenix and San Francisco metro areas.

The company’s real unlock will occur when it can push a software update enabling every Tesla owner to deploy their vehicle into the robotaxi network - think Airbnb. No other operator - Waymo included - can compete with this potential opportunity to seamlessly scale “overnight.”

The stock remains in a range (370 - 270) as traders battle to set a new trend. My bet is $TSLA will resume in the direction of the long-term underlying trend. I wouldn’t be surprised to see the stock tick an all-time high before year-end.

Here’s the daily chart.

And monster monthly chart.

If you enjoy this post, please share it with a friend.

Godspeed - Rosebee